The Gazette uses Instaread to provide audio versions of its articles. Some words might not be spoken correctly.

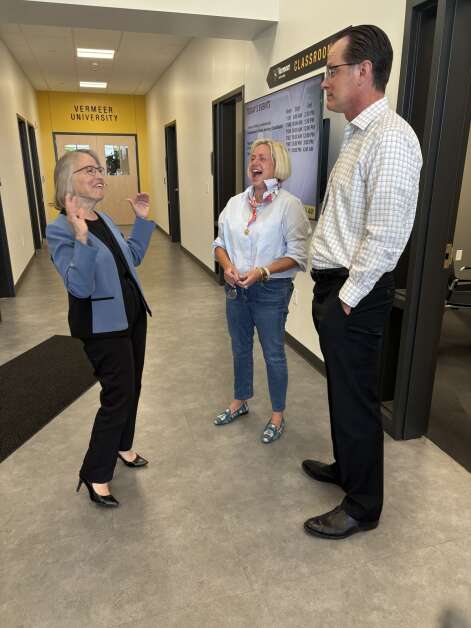

PELLA During her Monday visit of two Iowa factories, Republican U.S. Representative Mariannette Miller-Meeks praised federal tax reforms for promoting workforce training, research investment, and expansion.

Miller-Meeks utilized the trips to draw attention to tax breaks for Iowan industries found in Republican tax and spending legislation, which he nicknamed the “one big beautiful bill.” He said that the measures promote stability, encourage investment, and aid in fending off Chinese competition.

Among many other fiscal and policy measures, the act increases funding for border security and immigration enforcement, decreases future Medicaid expenditure, and permanently extends lower income tax rates and other important aspects of the 2017 Tax Cuts and Jobs Act.

According to Jason Andringa, president and CEO of Vermeer Corporation, “setting the long-term corporate tax rate at 21 percent allows us to plan for the long term, knowing what our tax rate is going to be.”

The Pella-based business produces a range of equipment for surface mining, agriculture, underground construction, tree care, and the environment.

Andringa said that it is crucial for us to be able to rapidly charge capital expenditures and research and development. With the help of these clauses, we may more confidently reinvest the great majority of our profits back into the company.

Since 2018, Vermeer has doubled in size. Company officials stated that they are once again in expansion mode, with plans to hire more staff in the near future and to look into extra industrial space in the upcoming years, following a time of stabilization that resulted in a temporary employment freeze.

According to Miller-Meeks, the experiences of Iowan manufacturers refute the argument made in Washington that expanding tax breaks would not spur economic expansion.

The “Big, Beautiful Bill” (also known as H.R. 1) is projected to have a mixed impact on economic growth. Through higher spending and tax cuts, the bill is expected to slightly increase GDP growth in the short term, according to the nonpartisan Congressional Budget Office (CBO). However, it will also result in a large increase in the national debt and possibly higher interest rates over time, which could slow long-term economic growth.

What I m hearing from you is exactly the opposite of what I heard from the CBO and critics, Miller-Meeks said. Actually, it’s boosting economic growth once again, surpassing the effects of the original Tax Cuts and Jobs Act.

According to Vermeer officials, the company’s capacity to train staff on new technology has been enhanced by the integration of federal and state labor programs.

“It’s a win for the economy, a win for Vermeer, and a win for our team members who get to come in and train on state-of-the-art equipment,” Andringa said. As Vermeer expands, so do our clientele, payroll, and tax base.

Miller-Meeks pointed to several key elements of the legislation, including $500 billion for skilled trades training, lower taxes on overtime, and permanently reinstating full expensing for domestic research and development expenditures. This means that instead of having to spread out the costs of their domestic R&D investments over a number of years, businesses can deduct the entire cost in the year that they are incurred.

Additionally, the new law restores full expensing for eligible production property, which allows firms to write off the full cost of new vehicles, machinery, equipment, and some building modifications in the year that they are put into operation. The instant deduction offers a substantial tax benefit, particularly for businesses going through big modernization or expansion projects.

Miller-Meeks stated that the majority of manufacturers she knows have employees who put in extra hours. Reducing overtime taxes is a significant factor in their ability to retain staff.

Additionally, by maintaining low tax bands, workers can take on more work or accept promotions without facing penalties from higher taxes, promoting workforce advancement and flexibility, she said.

According to her, these tax laws provide businesses with the confidence they need to invest in their employees and goods. Expensing, depreciation, and particularly R&D credits assist manufacturers in creating new goods, keeping workers, and avoiding tax hikes on overtime compensation.

According to her office, Miller-Meeks also made a stop at Cemen Tech, a volumetric concrete mixer maker in Indianola, where she spoke with staff members in a conference room and answered their inquiries regarding the bill, taxes, and artificial intelligence. The press was not allowed to participate in the roundtable discussion.

According to Cemen Tech management, the law has already increased company trust. In the two months following the bill’s passing, client demand has increased, according to Brant Pftantz, the company’s director of supply chain.

More orders have come in, Pftantz said. Our customers have that confidence now that the economy is going to take off, and it s happening.

The law was also acknowledged by the National Association of Manufacturers (NAM) in bolstering the sector. NAM official Erin Streeter, who attended the event, stated that the new provisions build on the momentum created by the 2017 Tax Cuts and Jobs Act, which gave manufacturing a boost.

“These tax provisions are very exciting because they will support the growth of manufacturers,” Streeter remarked. Additionally, we would like to thank the representative. To pull this over the finish line, she cast a daring vote.

“The legislation also supports U.S. competitiveness in artificial intelligence,” Miller-Meeks continued. According to her, AI can assist manufacturers in automating monotonous jobs so that employees can concentrate on more valuable work.

According to her, augmented intelligence is being used by manufacturers. It facilitates workforce and intellectual capital liberation for increased productivity in other domains.

She also mentioned the COVID-19 pandemic’s vulnerabilities and connected the law to initiatives to protect supply chains and lessen dependency on China.

Supply chains broke down because we were dependent on one supplier the Chinese Communist Party, Miller-Meeks said. Our goal is to assist domestic firms and diversify their supply networks.

Elected officials call for Miller-Meeks to host in-person town hall

Miller-Meeks recently received a letter from more than a dozen political leaders in Iowa’s 1st Congressional District, the majority of whom are Democrats, urging her to host a town hall meeting in person and hear the issues raised by the people of Southeast Iowa.

Miller-Meeks has spent the monthlong August recess traveling the district, meeting with constituents, local leaders and businesses privately to highlight the One Big Beautiful Bill’s impact on Iowans, and periodically taking questions from Iowa journalists.

The representative has attended 25 meetings and events, including three days at the Iowa State Fair, according to her office. However, she has not hosted any public events that are available to all constituents and has given little to no public notice of her visits.

In addition to hosting two telephone town halls this year, including one on April 29 that attracted over 6,300 callers, her office reported that she has visited all 20 counties in the district.

According to the letter, we beg you to host a town hall meeting in person and hear from the residents of Southeast Iowa. Voters who believe their congresswoman has let them down will not be helped by staged tele-townhalls or neat photo ops. You have to listen to the people who voted in the first district of Iowa and answer their questions. You would be betraying your commitment to the people of Iowa’s first district and ignoring your duty if you did not hold a town hall in person with prior notice.

“We’ll do in-person town halls, just like I’ve done every single year,” the congresswoman stated in April at a private gathering in Bettendorf.A week later, she reaffirmed that pledge.

“I meet with Iowans all year, and August is no different,” Miller-Meeks said in a statement to The Gazette. Meeting everyday people where they are, listening to them, and sharing what we’re accomplishing in Congress is the finest way to serve.

In order to emphasize the outcomes we are achieving in Congress, I will continue to interact with Iowans in a number of ways, including town halls, and I speak with constituents every single day through meetings, phone calls, and community events.

Comments can be sent to [email protected] or (319) 398-8499.